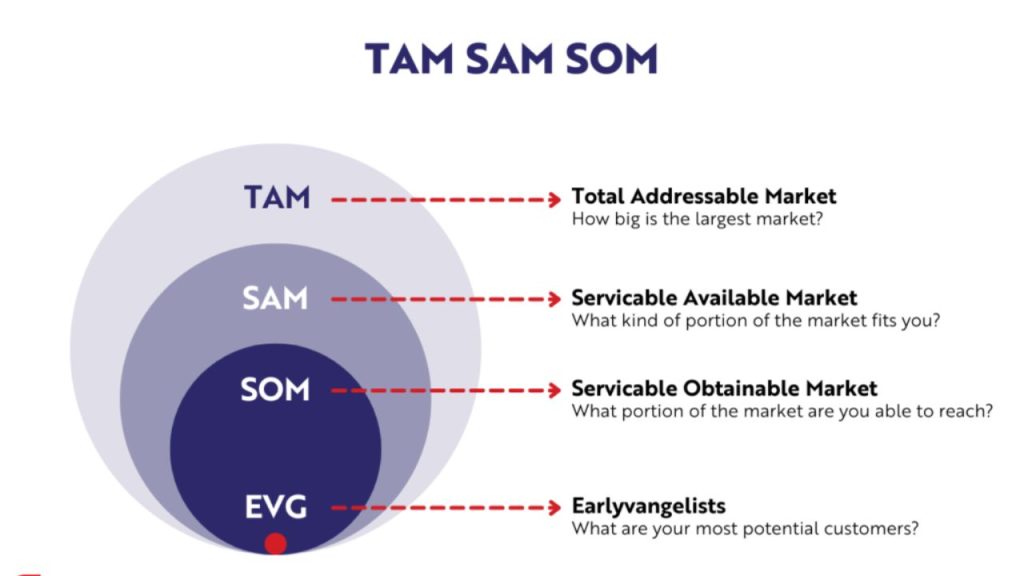

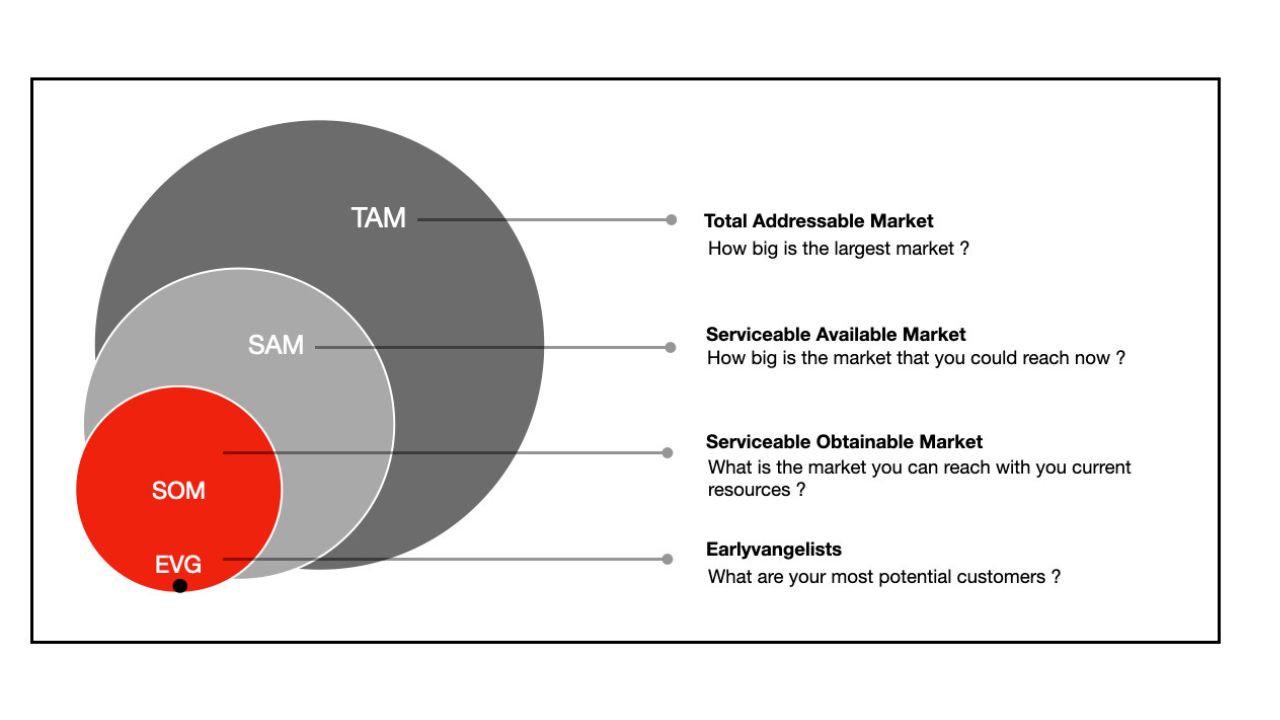

The acronyms TAM, SAM, and SOM are often used in market analysis reports and documents. The terms TAM, SAM, and SOM relate to a type of market data analysis that aids in estimating a specific business’s potential for growth

- TAM – Total Available/Addressable Market

- SAM – Serviceable Available/Addressable Market

- SOM – Serviceable Obtainable Market

The complete market for any good or service is referred to as TAM. It describes the entire population using a specific kind of item or service. However, no single brand can capture the whole addressable market.

Every brand targets a sub-segment of the TAM within a specific geographic zone with its unique product or service. This is known as the SAM. However, a single commercial organization cannot control all market conditions, prohibiting it from obtaining the entire SAM. The SOM is the portion of the SAM that a brand can get if it fully uses its resources and planning capabilities.

TAM SAM SOM Definitions:

TAM (Total Addressable Market): The whole market demand for a good or service is called the total addressable market, or TAM. It’s the most money a company can make in a particular market by offering its goods or services.

Businesses can determine the objective growth potential of a particular market by looking at the total addressable market. Businesses may also assess product market fit with the use of this data.

SAM (Serviceable Addressable Market): Your company model’s constraints (such as specialty or geographic restrictions) will make it difficult for you to serve the entirety of your target market.

Businesses may utilize a serviceable addressable market to determine their objectives by objectively estimating the portion of the market they can realistically obtain.

SOM (Serviceable Obtainable Market): You can’t take up your serviceable addressable market share unless you have a monopoly. It would be challenging to persuade a whole market to purchase your good or service exclusively, even if you had just one rival. Because of this, determining the size of your viable, attainable market is essential to determining the approximate number of clients who would profit from purchasing your good or service.

Businesses may use the Serviceable Obtainable market to set short-term growth objectives. Moreover, it can support strategic planning and competitive awareness.

Benefits of TAM SAM SOM Analysis for Investors:

- One response is that the TOM SAM SOM analysis aids in persuading investors of a company’s potential for development.

- The investor may decide whether to invest and whether there is real profit potential in the market by using the SAM SOM values. The investor may gain comprehensive insights into the types of organizations, income streams, and investment patterns in a particular industry by pinpointing the target business’s actual sector with the aid of the total addressable market.

- Finding your TAM SAM SOM lowers investor risk and improves the company’s ability to attract further investors.

Benefits of TAM SAM SOM analysis for business owners:

Contacting potential new investors using TAM SAM SOM is not just a good idea. A TAM SAM SOM study may also assist managers and business owners in better understanding their company.

- First, an entrepreneur may determine whether their firm is financially feasible using a TAM SAM SOM analysis. A company concept with a tiny SOM won’t always be economically viable.

- A business may also learn more about its target market through a TAM SAM SOM study. The initial expenditure required to launch the firm may be computed using this value.

- Sam TAM SOM analysis is valuable for evaluating a company’s performance. Regular evaluation of the company’s ability to meet its SOM objectives is recommended. A system overhaul is required if the company’s expected system output margin (SOM) deviates significantly from its actual SOM. This might indicate operational impediments.

- Poor CRM and lead creation often account for the difference between the ideal and actual SOM. Many businesses ignore and don’t reach out to a significant portion of their SOM. To ensure that a larger percentage of their SOM turns into actual customers, they must expand their database and improve lead contact creation.

- Future strategies may be determined using the TAM SAM SOM analysis. A firm may refocus its primary target sector if it discovers that while its TAM is robust, its SAM/SOM statistics are insufficient. Companies may change what they provide to appeal to more customers and increase their chances of growing.

- A company’s TAM SAM SOM study aids in developing a realistic market value that owners may present to potential investors.

How do you calculate your TAM SAM SOM?

TAM SAM SOM analysis is extremely important for investor pitches and business operations, although it is not widely used in the corporate sector. Even though many market researchers may be aware of the analysis, they might not fully understand how it works. Two methods exist for carrying out a TAM SAM SOM analysis:

- Top-down style

As the name implies, the top is where this study starts. Market analysts use broad data on the industry sector to determine the highest possible total addressable market for the firm.

The researchers then determine the SAM of the company’s demographic information, consumer purchasing patterns, and other long-term economic considerations. The SOM is calculated using the available statistical data on the average income of different businesses in that industry and the SAM. The particulars of a specific company are not taken into account.

When a fresh idea is being tried, this top-down analysis could work well for the initial pitch to potential investors. It examines the company idea’s potential for development and profit. But before making their ultimate investment choice, most investors prefer a more thorough TAM SAM SOM research.

- Bottom-up style

This whole addressable market strategy Sam A deeper company-specific view of the market potential is provided by SOM. Investors looking to reduce risk before making significant investments always desire a bottom-up TAM SAM SOM.

Using the bottom-up TAM SAM SOM methodology, the researcher gathers information on the company’s current sales, sales leads, and overall product volume. The SOM analysis makes use of this data. Still, this data is insufficient. Data from market research about the TAM and SAM sizes should be used to supplement the complex numbers from business statistics.

Combining the company’s potential with overall market data gives investors a comprehensive view of their possible gains and losses. Thus, the optimal method for calculating TAM, SAM, and SOM combines top-down and bottom-up approaches, calculating TAM and SAM top-down and SOM bottom-up.

How Does TAM SAM SOM count?

Planning for growth and company strategy requires understanding TAM, SAM, and SOM. This is so that it can be seen from these measures how much potential there is in a particular market at every level of business expansion.

TAM SAM SOM is helpful since it presents an idea’s worth in an easy-to-understand manner. Teams may use this data to get insight into a market or niche’s target audience and potential revenue streams.

When a company seeks funding, these indicators convey essential information to potential investors. The process makes decisions that influence growth simpler.

Let’s take the scenario where you cannot identify the appropriate section for your SAM. Your serviceable addressable market may become overly large, affecting your SOM.

TAM SAM SOM Template:

After learning the definitions and applications of each acronym, let’s get into the specifics of calculating TAM, SOM, and SAM. This calls for thorough market research beforehand, but once you have those numbers, here are the calculations you use:

Total Addressable Market (TAM) Calculation:

An industry’s total addressable market is best determined by bottom-up examination. When doing a bottom-up study, the total number of clients in a market is multiplied by the average yearly revenue of each client in that market.

Serviceable Addressable Market (SAM) Calculation:

Add together all the prospective clients who would be a suitable fit for your company, then multiply the total by the average yearly revenue of these clients in your market to determine your serviceable addressable market.

Serviceable Obtainable Market (SOM) Calculation:

Divide your previous year’s sales by the serviceable addressable market in your sector. This represents your prior year’s market share. Next, take this year’s serviceable addressable market for your industry and double it by your market share from the previous year.

Read Also – What Is A Suggested Tax Attorney In Washington, DC?