With the financial year coming to an end, the need for Canadian residents to file tax returns becomes a pressing concern. The Canada Revenue Agency (CRA) offers an invaluable online platform, the CRA Account, to facilitate various tax-related processes. This article serves as a detailed guide to help you understand how to create, login, and use your MyCRA account efficiently, ensuring both tech-savvy and non-technical individuals can navigate the system with ease.

What is a CRA Account?

The CRA Account is a secure online service provided by the Canada Revenue Agency. This platform enables individuals and entrepreneurs to manage their taxes and related financial details effectively. The account features include access to tax information such as account balances, contributions, T4 slips, various deductions, and more. Users can also submit documents, adjust previous returns, and check updates about their tax status.

Creating a CRA Account

Step-by-Step Guide to Registration

- Visit the CRA Website: Start by navigating to the official Canada Revenue Agency website.

- Locate the Registration Option: Look for the “CRA Register” link and click on it.

- Enter Your Details: You will need to provide your Social Insurance Number (SIN), date of birth, and the amount entered on your last tax return.

- Create Login Credentials: Follow the prompts to create a username and password.

- Set Up Security Questions: Choose your security questions and provide answers for future verification.

- Complete Registration: After these steps, your account will soon be ready to use.

Logging into Your CRA Account

Simplified Access

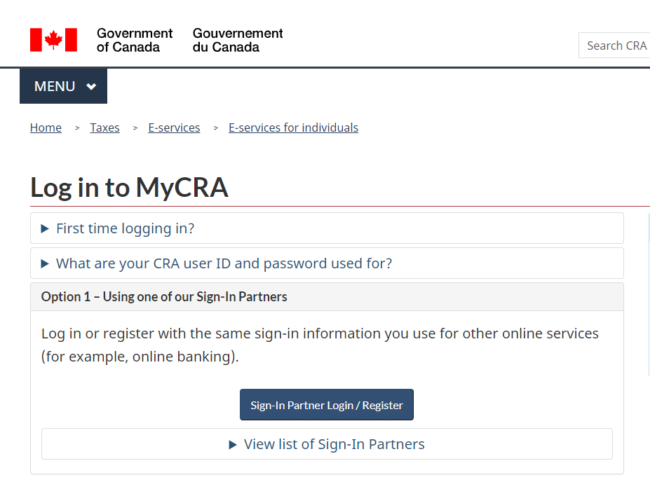

- Open the CRA Website: Go to the Canada Revenue Agency website and select “My Account.”

- Choose Your Login Method: You can log in using a CRA user ID and password, or via a Sign-In Partner (such as your online banking).

- Input Your Credentials: Enter your chosen credentials or select your bank for the Sign-In Partner option.

- Answer Security Questions: Provide answers to your pre-set security questions.

- Access Your Account: You can now view your dashboard and manage your tax details.

Tips for a Trouble-Free Login Experience

- Update Your Information: Regularly update your contact details to ensure you receive all notifications.

- Remember Your Credentials: Keep a record of your login information and security question answers.

- Use Secure Connections: Always access your account from a secure internet connection.

- Contact Support: If you encounter issues, use the support services provided on the CRA website.

Why You Need a CRA Account

Benefits of the CRA Account

- Easy Access to Tax Information: Quickly view your tax status, notice of assessment, and past returns without the need for physical documents.

- Convenient Document Management: All your tax-related documents are stored securely online.

- Simplified Tax Filing: The CRA Account streamlines the tax filing process by providing access to necessary documents and real-time tracking of your tax return.

- Direct Applications for Benefits: Apply directly for government benefits and credits through your account.

- Immediate Updates: Receive real-time notifications about tax deadlines and account changes.

- Enhanced Security: The CRA uses strong security measures to protect your personal and financial information.

- Efficient Communication: Easily communicate with the CRA through your account, reducing wait times for responses.

Frequently Asked Questions (FAQs)

Q1: Can I access my CRA account on mobile?

A1: Yes, the CRA offers a mobile app called MyCRA, available for both Android and iOS devices, where you can access your tax information on the go.

Q2: What should I do if I forget my CRA account password?

A2: You can reset your password by following the ‘Forgot password’ link on the login page and answering the security questions associated with your account.

Q3: How secure is the CRA Account?

A3: The CRA employs robust security measures, including secure access protocols and encryption, to protect user data.

Q4: Can I authorize someone else to manage my CRA Account?

A4: Yes, you can authorize a representative through the ‘Authorize my representative’ option within your account settings.

Q5: Are there any fees associated with using the CRA Account?

A5: No, accessing and using the CRA Account is free for all users.

An indispensable tool for handling your taxes in Canada is the CRA Account. The Corporation for Revenue Administration (CRA) offers a complete platform to manage tax returns, refund status checks, and personal information updates in an expedient manner. Through adherence to the instructions provided in this handbook, you may guarantee a trouble-free CRA Account experience. It has never been simpler to manage your taxes online thanks to the advantages of shortened procedures and secure access.

Read Also – $5,200 Stimulus Check Coming for Seniors on SSI: Know Payment Dates & Eligibility