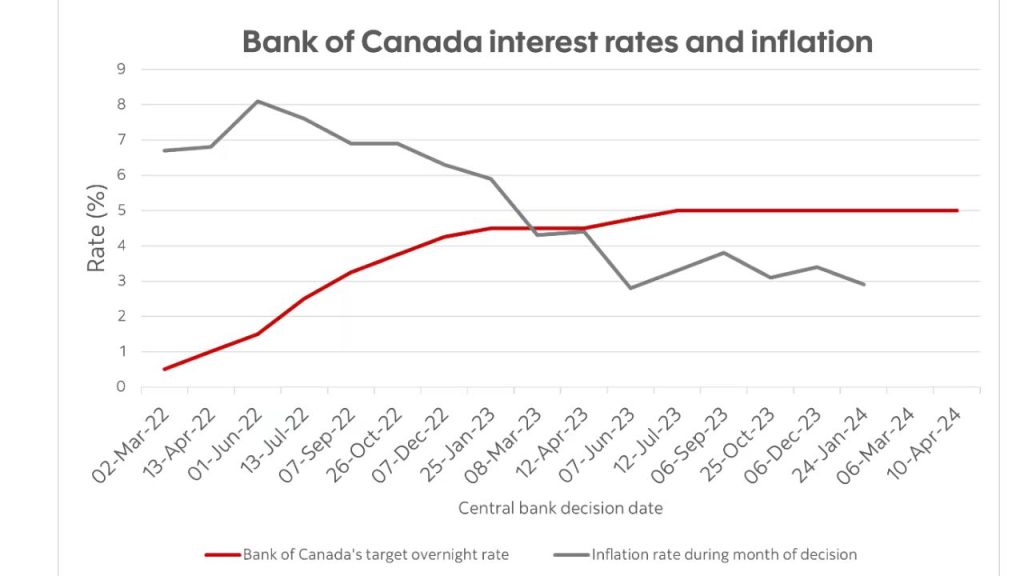

Here are the specifics of the ScotiaBank Interest Rate Changes for 2024, including the Prime Rates for 2024 compared to 2023 and the Expectations for 2025. The bank is raising interest rates in response to the present state of inflation. In this post, we’ll talk about whether or not Scotiabank interest rate changes occur. The Bank of Canada sets the Bank of Canada has set a 5% target overnight lending rate. On April 10, the central bank decided to keep rates unchanged. On June 5, the interest rate will be chosen.

Scotiabank Interest Rate Changes 2024:

Banking services allow customers to save their hard-earned cash. Those who want to remain in Canada have opened an account with Scotia Bank to safeguard their income. To utilize the banking products going forward, they must be aware of interest rate adjustments.

As of January 24, 2024, the bank’s prime rate is 7.20%. The Bank of Canada, however, has declared that its rates would only be changed to 5%. The savings account will have an interest rate of 4.35%. Please take notice that these are the February changes.

Regarding Scotia Bank:

Some clients have played a significant role thanks to the excellent financial services. There are currently millions of active clients at Canada’s top bank. Being current with the most recent changes in the market is crucial for the bank. At present, the bank’s assets amount to around Can$1,136 billion.

The bank offers various private, investment, commercial, international, and personal banking services. Customers will find the interest rates on banking products to be competitive. To learn more about the prompt, continue reading.

The nation’s people can apply to the bank for any kind of account—personal, business, or otherwise. Customers can visit the closest office or order the services online. The representatives will assist the clients in completing the form and obtaining the necessary banking products.

Scotiabank, the leading financial service supplier, offers various customer care options. The loan comes first, followed by the savings account and the investments. The bank bears the burden of guaranteeing that the money will be saved.

Prime Rate Forecasts for 2025 Compared to 2023:

The substantial rate adjustments are essential to improving the bank’s financial soundness. As we’ve already covered, millions of Scotiabank clients rely on the bank’s services and hope for further success.

Prime rates are typically set by the Bank of Canada and are used by all banks. The market capitalization determines the rate. Interest rates would likely fluctuate throughout the following years.

The 7.2% rate is a revision from the prior year. The tariff is being maintained to make things easier for the clients. The public anticipates that there will be another revision to the rates due to the nation’s high cost of living and inflation.

Customers must access the banking website in their web browser to view the bank’s prime rates. Make sure your internet connection is reliable. Sign in to the portal now. The pertinent link is available on the main page. Click the link and fill in the vital information. After some waiting, the display containing the required data will appear.

Additionally, clients can reach out to the bank by phone or email. Please do not hesitate to ask the officials any questions. When assisting you with the financial services, they will be courteous. Invest in equities or mutual funds to get the most out of the bank. Consult financial advisors to make sure your passive income keeps increasing.

The stakeholders anticipate the forthcoming year’s significant developments. Customers may be asked to pay a fee to handle their accounts as they consider improving the banking experience. The bank allows you to hire an accountant to handle specific accounting-related issues. Please be aware that interest rate adjustments are often made before the conclusion of the fiscal year. Thus, wait for the appropriate moment to get the most out of the financial services.

| Bank of Canada decision date | Interest rate (%) | Change (%) | Inflation rate (%) |

| Apr. 10, 2024 | 5.00 | – | TBA |

| Mar. 6, 2024 | 5.00 | – | 2.9 |

| Jan. 24, 2024 | 5.00 | – | 2.9 |

| Dec. 6, 2023 | 5.00 | – | 3.4 |

| Oct. 25, 2023 | 5.00 | – | 3.1 |

| Sept. 6, 2023 | 5.00 | – | 3.8 |

| July 12, 2023 | 5.00 | +0.25 | 3.3 |

| June 7, 2023 | 4.75 | +0.25 | 2.8 |

| April 12, 2023 | 4.50 | – | 4.4 |

| March 8, 2023 | 4.50 | – | 4.3 |

| Jan. 25, 2023 | 4.50 | +0.25 | 5.9 |

| Dec. 7, 2022 | 4.25 | +0.50 | 6.3 |

| Oct. 26, 2022 | 3.75 | +0.50 | 6.9 |

| Sept. 7, 2022 | 3.25 | +0.75 | 6.9 |

| July 13, 2022 | 2.50 | +1.00 | 7.6 |

| June 1, 2022 | 1.50 | +0.50 | 8.1 |

| April 13, 2022 | 1.00 | +0.50 | 6.8 |

| March 2, 2022 | 0.50 | +0.25 | 6.7 |

Read Also – Attorneys Calculate the Price of “Pain and Suffering” in a Personal Injury Lawsuit