The amount of the Parenthood Tax Rebate 2024 is intended to lessen parents’ financial burdens and promote family planning. The PTR lowers the qualifying parents’ taxable income and is available to Singaporean residents. The kid must be a Singaporean citizen under 16 to qualify for the payout.

The number of children you have will determine how much of a rebate you receive; to find out how much you might receive, visit the Singapore Parenthood Tax Rebate Eligibility 2024. The correct steps in the article below have discussed the PTR claim process.

Parenthood Tax Rebate 2024:

The Parenthood Tax Rebate is provided to Singaporean people who meet the eligibility requirements, making it easier for them to raise their kids. It’s not simple to raise a child, so several residents have been having financial difficulties. The purpose of the tax relief program is to lessen parents’ financial burdens and promote family planning. The Singapore Parenthood Tax Rebate 2024 is intended to lower parents’ taxable income; however, parents must be Singaporean residents and have at least one child under sixteen to be eligible for the payment.

The PTR undoubtedly seeks to lessen your financial load so you can concentrate on the essentials and provide your child with the best start. The required Singapore Parenthood Tax reimbursement Eligibility 2024 is for parents, guardians, divorced, or widowed parents to get the reimbursement. Each kid in the home will receive a specific refund amount, and the payment amount is based on the total number of children.

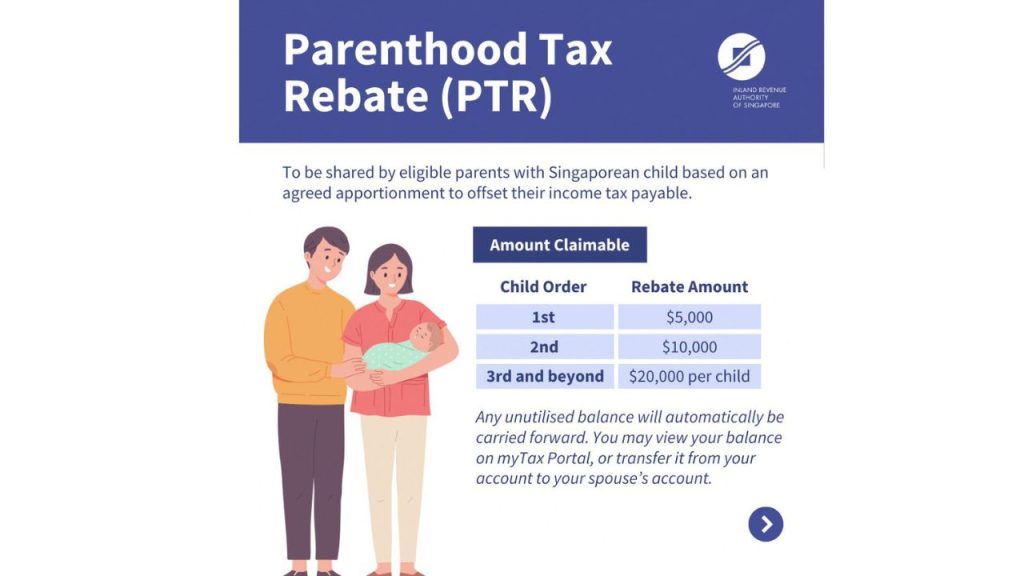

The joint rebate, which depends on how much time you have spent with your kid, must be applied for by both parents if they share custody of the child. All of the young parents who have been concerned about their money and raising their children will benefit from this refund. $5000 will be the refund amount for the first kid, $10000 for the second, and $20000 for the third. The money will then be disbursed accordingly. Read this page to learn in detail about the Singapore Parenthood Tax Rebate Eligibility and the rebate amount awarded to your kid in 2024.

Singapore Parenthood Tax Rebate 2024:

- The Singaporean Inland Revenue Authority’s goal is to offer tax rebates to qualified individuals whose children are nationals of the nation.

- All dependent children’s child care is eligible for the Parenthood Tax Rebate 2024, and the parents or legal guardians can claim the whole amount.

- The number of children in the home affects the refund, and their age also affects how much they can get.

- Only if both parents apply together will they be eligible for the refund if they jointly share custody of the kid.

- This payment will lessen the financial strain on young parents, who frequently struggle between caring for their children and managing their finances. Raising children is not an easy task.

Parenthood Tax Rebate Payment Amount:

| Order Of Child | Child Born Between 2004 and 2008 | Child Born After 2008 |

| 1st child | $0 | $5000 |

| 2nd child | $10000 | $10000 |

| 3rd child | $20000 | $20000 |

| 4th child | $20000 | $20000 |

| 5th child and subsequent | $0 | $20000 per child |

Eligibility for the Parenthood Tax Rebate:

There are a few prerequisites to be eligible to receive the sum. This section covers the requirements that must be met to get the money.

- The parents ought to live in the nation permanently. To demonstrate their residency, they need to have residential documentation such as fuel, water, and electricity bills.

- The infant ought to be born within the nation. Children born outside the country must present a birth certificate and other paperwork.

- The child’s parents ought to be their primary guardians.

- You should give the youngster education information about the schools and their associated costs.

- The guardians or the adoptive parents should file the PTR for the adopted children. The adoption paperwork is required to receive their reimbursement.

- The working single mother must present job documentation, including the pay stub and employer information.

- The distribution amount will be determined by considering both parents’ combined annual income.

- To be eligible for the allowance, the parents must complete the unfiled tax returns from the prior year.

The sum will be awarded to the divorcing couple sharing custody per their child-support contributions.

How to claim the rebate?

- Use your Singpass or Singpass Foreign User Account (SFA) to access the myTax Portal.

- Go to “Individuals” > “File Income Tax Return.”

- Then select “Edit My Tax Form.”

- Go to “4. Reliefs and Deductions for Parenthood Tax Rebate.”

- “Parenthood Tax Rebate (For NEW Claims Only)” is the option to select.

- Once you have chosen “Update,” enter your claim.

- Any cash that is not utilized is automatically carried forward to lower your future tax liability.

PTR Management in Various Situations:

PTR is distributed differently to each child in the family, based on their position in the hierarchy.

PTR for kids placed for adoption:

- The parents do not owe the child any PTR.

- The parents lose their PTR rights after the child is put up for adoption. The remaining PTR balance is forfeited. For instance, if the child is put up for adoption in 2021, the parents will no longer be eligible to claim any unused PTR balance from the Year of Assessment 2022.

If a court order dissolves the marriage:

- You and your ex-spouse may utilize any remaining credit balance in your PTR accounts to lower future tax payments.

- If one spouse dies, you may utilize any remaining credit balance in your PTR accounts to lower your future tax liabilities.

To Know More Latest Finance News then Visit – stevedigioia.com