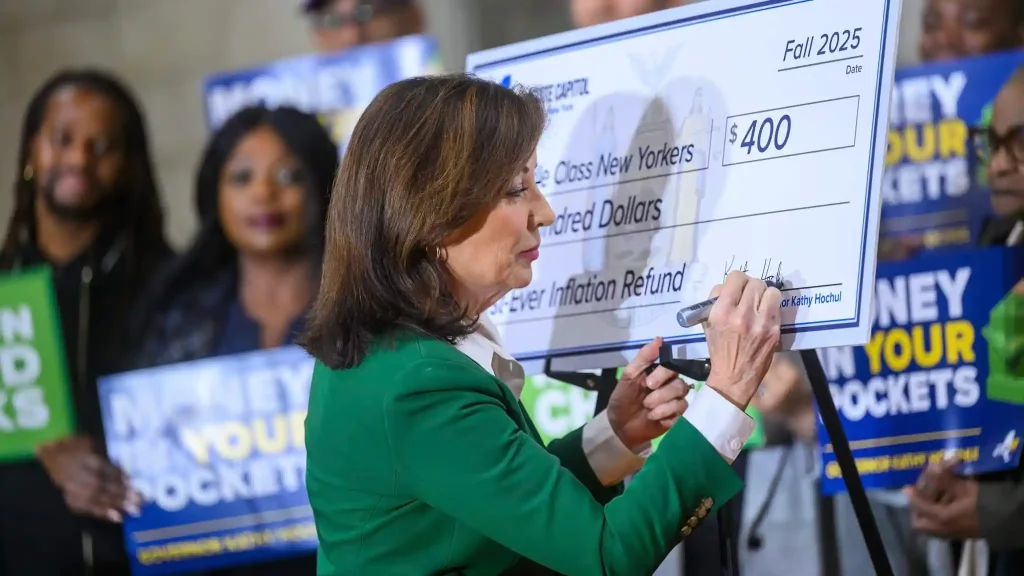

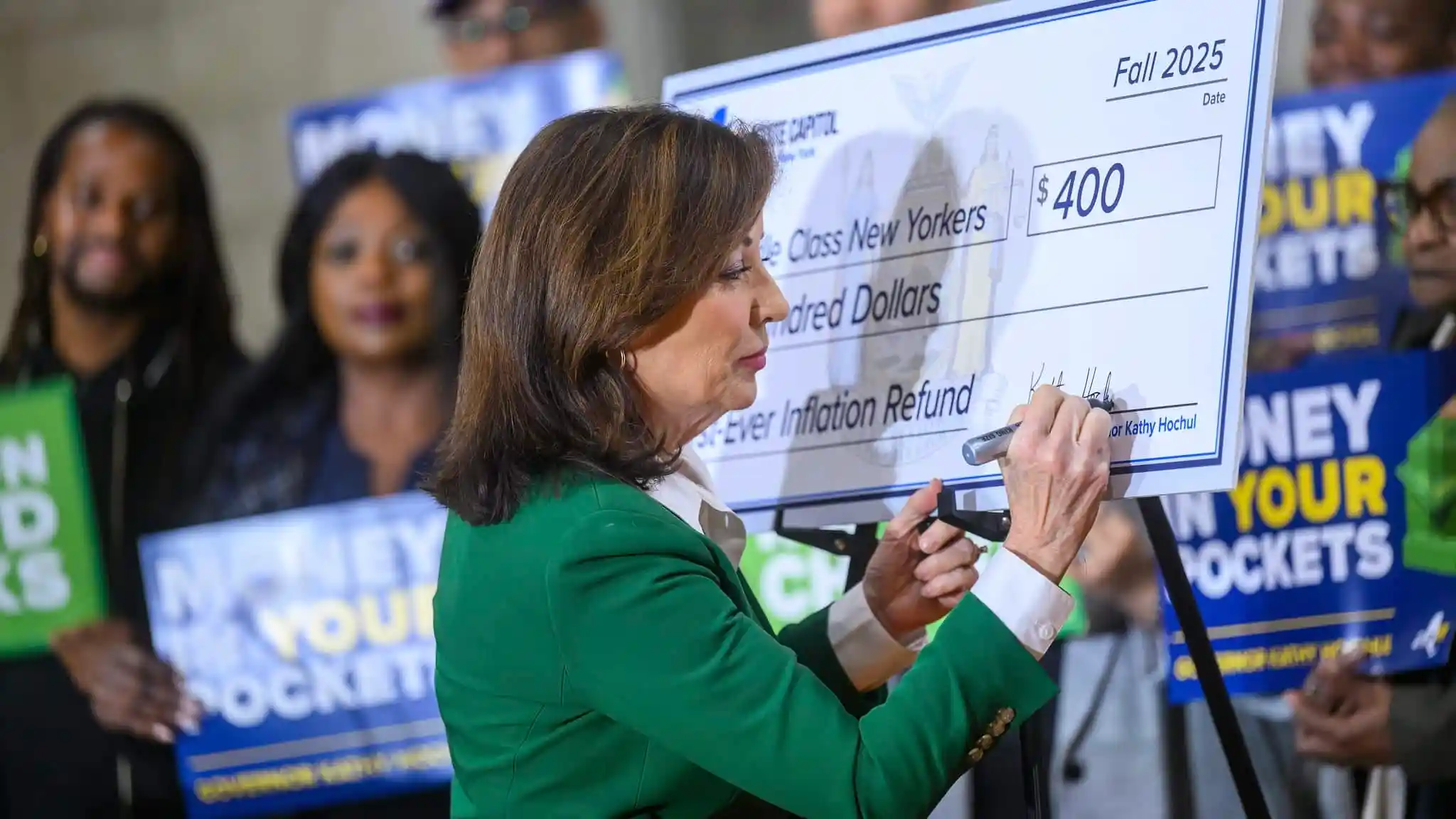

New Yorkers, check your mailboxes — a surprise $400 check could be heading your way this fall, and you won’t have to lift a finger to get it. That’s right, under a new $2 billion initiative baked into New York’s latest state budget, millions of residents will automaticaally receive an “inflation refund” check in the mail. No applications, no websites to visit, and absolutely no strings attached.

This new relief package was quietly finalized as part of New York’s $254 billion budget for the 2025-2026 fiscal year. The goal? To help everyday New Yorkers cope with soaring costs caused by persistent inflation. Over 8 million households are expected to benefit, with payments of up to $400 per household, depending on income and filing status.

Who’s Eligible for the $400 Inflation Refund?

Not everyone will get the full $400, but if you filed a full-year New York State income tax return (Form IT-201) for 2023, you’re already halfway there.

To qualify, you must:

-

Have lived in New York State for the entire 2023 tax year.

-

Not be claimed as a dependent on someone else’s return.

-

Have a 2023 New York Adjusted Gross Income (AGI) within certain limits:

For single filers, heads of household, or married filing separately:

-

Earned $75,000 or less: $200

-

Earned between $75,001 and $150,000: $150

For married couples filing jointly or qualified surviving spouses:

-

Earned $150,000 or less: $400

-

Earned between $150,001 and $300,000: $300

It’s a tiered system, designed to give the largest relief to lower and middle-income families — the very people hit hardest by rising prices for groceries, rent, and utilities.

When and How Will the Checks Arrive?

This is where it gets really easy. You don’t need to apply. There are no forms, no phone calls, and no online portals.

The checks will be mailed automatically starting mid-October 2025 and will continue through November. However, you must ensure your current mailing address is correct with the New York State Department of Taxation and Finance, especially if you’ve moved since filing your 2023 tax return.

Importantly, the payments will not be issued via direct deposit, even if that’s how you received your tax refund. So don’t be surprised when a paper check shows up in your mailbox — that’s by design.

What You Should Do Right Now

Even though no action is needed to apply, there’s one critical step you should take: make sure your mailing address is up to date.

If you’ve moved recently, head to the NYS Tax Department’s Online Services portal and update your profile. If the check is sent to an old or incorrect address, it could delay or even prevent you from receiving your refund.

This program is a clear attempt by New York lawmakers to put money back into the hands of residents ahead of an uncertain economic stretch. While $400 won’t solve everything, it might just provide a little breathing room as prices continue to climb.