The Social Security trust funds will be insolvent by Fiscal Year (FY) 2034, according to projections by the Congressional Budget Office (CBO), at which point the law calls for a 23 percent cut in benefits.1 Restoring solvency over the next 75 years would require the equivalent of reducing all future benefits by 24 percent or increasing revenue by 35 percent.

Vice President Kamala Harris has said she would “protect Social Security,” and former President Donald Trump has said he would “fight for and protect Social Security.” Unfortunately, neither candidate has presented plans to fix Social Security’s finances despite the looming $16,500 cut facing a typical couple retiring just before insolvency.

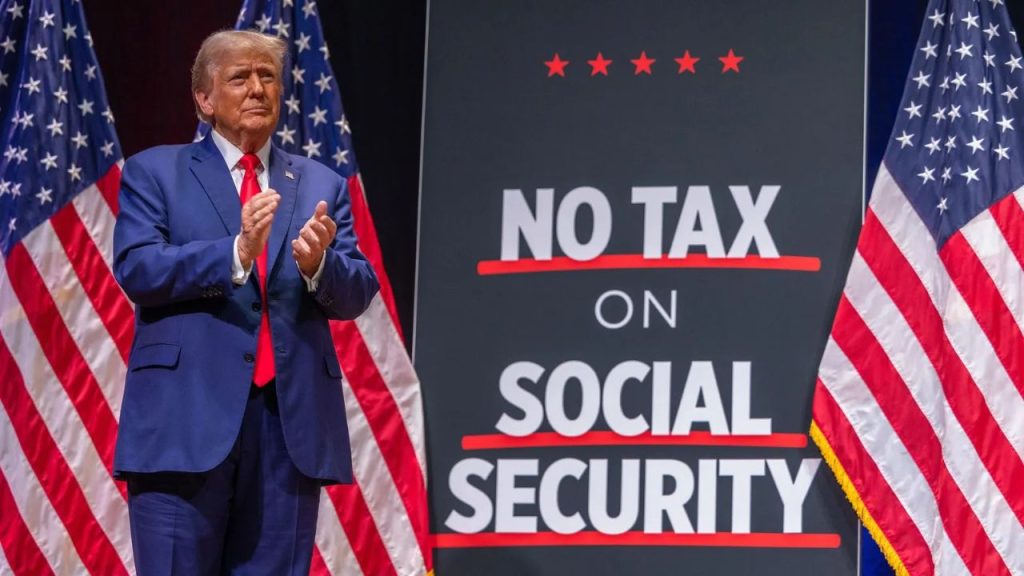

In fact, we find President Trump’s campaign proposals would dramatically worsen Social Security’s finances.2

President Trump’s proposals to eliminate taxation of Social Security benefits, end taxes on tips and overtime, impose tariffs, and expand deportations would all widen Social Security’s cash deficits. Under our central estimate, we find that President Trump’s agenda would:

Increase Social Security’s Ten-Year Cash Shortfall By $2.3 Trillion Through FY 2035

Advance insolvency by three years, from FY 2034 to FY 2031 – hastening the next President’s insolvency timeline by one-third.

This led to a 33 percent across-the-board benefit cut in 2035, up from the 23 percent CBO projects under current law.

Increase Social Security’s annual shortfall by roughly 50 percent in FY 2035, from 3.6 to 4 percent of payroll.

Require the equivalent of reducing current law benefits by about one-third or increasing revenue by about one-half to restore 75-year solvency.

US Budget Watch 2024

is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms.

Throughout the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office.