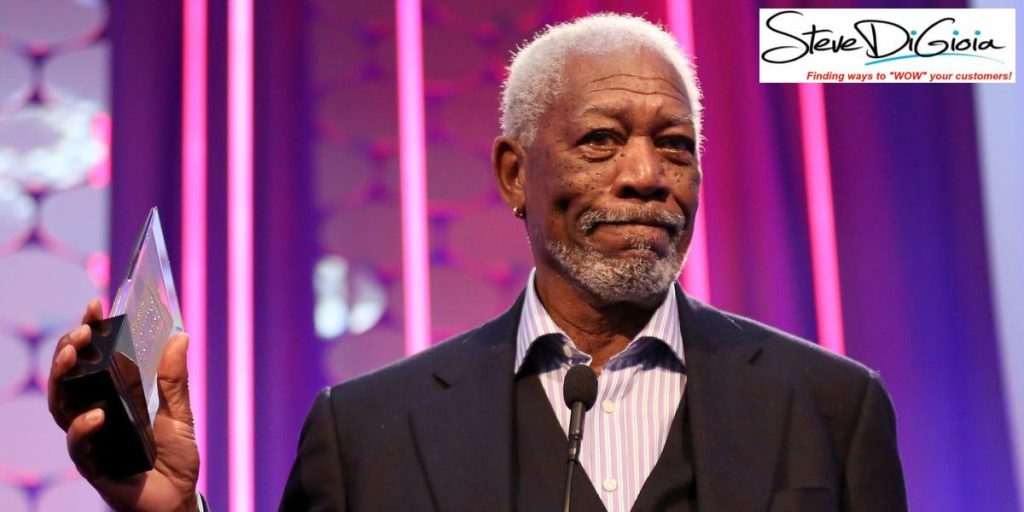

In a surprising turn of events, Tesla CEO Elon Musk has brought back the spotlight to a 2016 interview featuring the beloved actor Morgan Freeman, where he revealed his ownership of Tesla stock. Since that time, the value of Tesla’s stock has skyrocketed, astonishing investors and fans alike. Now, as we look at Tesla’s remarkable growth, it begs the question: What does this mean for current investors and potential buyers?

Elon Musk Resurfaced a 2016 Interview

Recently, Musk shared a nostalgic clip from a 2016 CNBC interview where Freeman spoke about owning shares of Tesla. Since that conversation, the stock has shown some jaw-dropping growth. In fact, Tesla’s share price has skyrocketed almost thirty times from where it was back then. The idea that a simple conversation could highlight such incredible investment success has really captured people’s attention!

A Tesla Share Bought at the Time Would Be Worth About 30 Times as Much

Can you imagine investing just $10,000 in Tesla back in 2016? Today, that investment would be worth an astonishing $307,000! This is an extraordinary increase and demonstrates how Tesla has transformed into one of the most valuable companies in the world, moving its market value from around $30 billion to an impressive $1.3 trillion.

A Publicist for Freeman Declined to Elaborate on His Stock Holdings

While Musk’s reveal caught many by surprise, Freeman’s publicist decided to keep quiet about the details surrounding the actor’s investments in Tesla. This mystery has left everyone wondering just how early Freeman was to his investment and how it may have impacted his financial future. Was this actor, renowned for his roles and storytelling, also a savvy investor?

How Tesla Became a Household Name

The rise of Tesla from a car company to a global leader in sustainable energy is truly remarkable. Back in 2016, the automotive landscape looked very different. Tesla’s revenue was around $7 billion, but today it has exploded to a staggering $97 billion. Their journey represents not just a company’s growth, but a shift in how we think about transportation and clean energy.

The Significance of Tesla’s Growth for Investors

For those thinking about investing in Tesla today, it is essential to recognize both the potential rewards and the risks involved. Tesla is facing some challenges, including slowing growth in profits and competitive pressure in the electric vehicle market, along with ongoing development in self-driving technology. An informed choice requires a look beyond the headlines.

What Analysts Are Saying About Tesla Stock Today

As we look toward the future, analysts have mixed feelings about Tesla. For example, as of now, Tesla’s stock has increased by 100% in just the past year. However, there are talks about potential slowdowns, with many analysts deciding to hold or sell rather than buy more stock. This hesitation is mainly due to Tesla’s decreasing profit margins and concerns regarding its ambitious plans. With a price-to-earnings ratio currently at 111, some experts suggest investors might want to tread carefully before diving in for more, even with Tesla’s strong brand identity.

| Year | Revenue (in billion $) | Market Cap (in trillion $) | Stock Price Increase (%) |

|---|---|---|---|

| 2016 | 7 | 0.03 | N/A |

| 2023 | 97 | 1.3 | 3000% |

As Tesla continues to innovate, the road ahead remains exciting yet unpredictable. Whether you are an old follower of the brand or new to investing in Tesla, it’s essential to stay informed about both the bright and challenging prospects ahead!