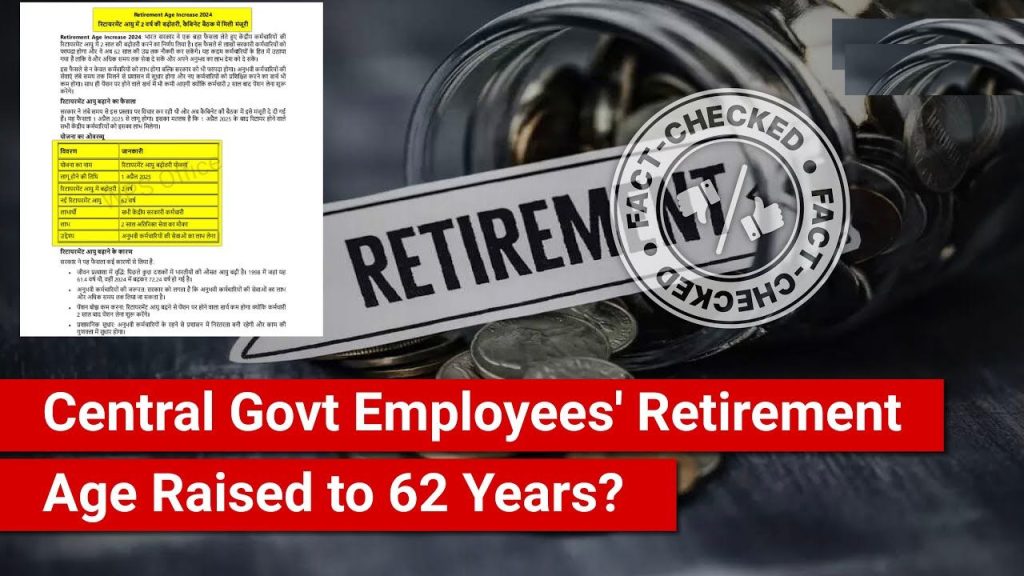

Viral Arrested Claim of Higher Retirement Age in Central Government Employees Debunked by PIB

New Delhi: A viral post circulating on social media says that the Government of India has decided to increase the retirement age of central government employees from the current age of 60 to 62 by two years.

Many who saw the post have taken to social media to comment about the supposed benefits of such a move, and the post is accompanied by a notice — ‘Retirement Age Increase 2024’ — under it. However, upon verification, the claim turned out to be fake, as the Press Information Bureau (PIB), the official government agency for sniffing factual data, debunked it.

Viral Post Claims: A Closer Look

A message shared widely on social media platforms says that in a cabinet meeting, the Indian government approved increasing the retirement age of central government employees.

The notice said the decision would guarantee that workers could work for two more years, until the age of 62, from April 1, 2025. According to the post, the move is also meant to be beneficial for the employees and the government.

The reasons provided in the message include:

- Rising Life Expectancy: Over the last several decades, life expectancy in India has increased significantly. It is projected to increase from 61.4 years in 1998 to 72.24 years in 2024.

- Demand for Experienced Employees: The government understands that it is important to keep experienced employees because their talent can add value for a long while.

- Reducing Pension Costs: Lowering pension-related expenses would be achieved by extending the retirement age to two years from the current day.

- Administrative Continuity: An old workforce of competent people retains smooth administrative operation at the borders of efficiency and overall performance.

Implications And Considerations

The confusion surrounding this issue underscores the importance of verifying information before accepting it as fact. For current employees and those planning their retirement strategies, understanding the actual policies is crucial for effective financial planning.

While there are discussions about potential reforms in retirement policies across various sectors—some states have indeed considered raising their retirement ages—no such initiative has been officially adopted at the central level as of now.

The implications of raising the retirement age could be significant; it would not only affect pension liabilities but also impact workforce dynamics and job opportunities for younger generations entering public service.