The holiday season brought surprising news for the economy as the Consumer Price Index (CPI) increased by 0.4% in December. This rise marks the fastest monthly increase since February and signals some challenges for the Federal Reserve in its ongoing battle against inflation. The overall annual CPI jumped to 2.9%, raising questions about what these changes mean for everyday Americans and the broader economy.

Understanding CPI’s Impact

The Consumer Price Index is a key measure that helps us understand how much prices are changing for things we buy, such as groceries and gas. When we see an increase in CPI, like the 0.4% rise reported in December, it usually means that consumers are feeling the effects of inflation. Experts note that the increase in egg prices and other grocery items played a big part in this rise. It’s essential to pay attention, as this reflects how much more families need to spend on these basic necessities.

Core Inflation: The Bigger Picture

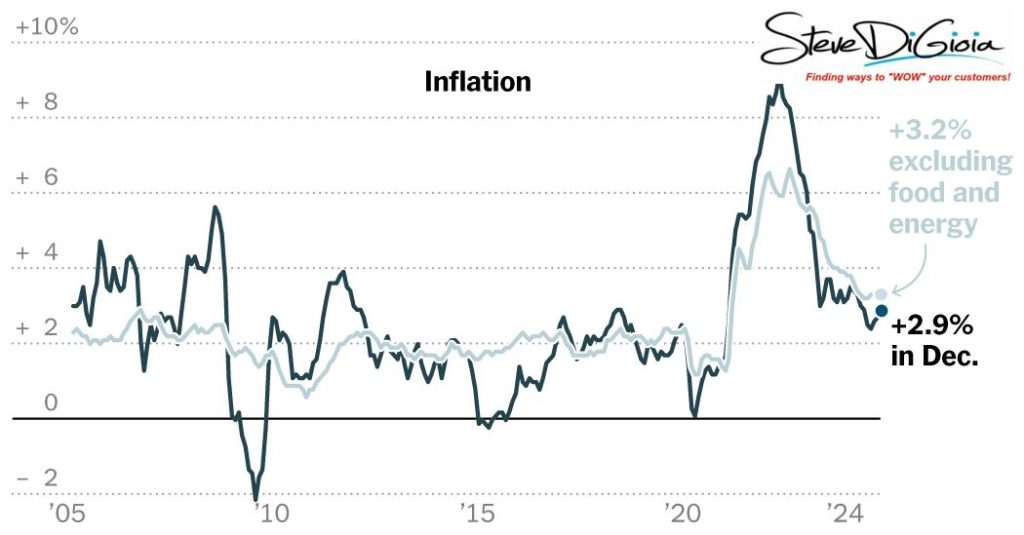

It’s not just the overall CPI we need to watch. Core inflation, which excludes the prices of food and fuel because they can fluctuate a lot, also saw a change. In December, core inflation climbed by 3.2% compared to last year. While this suggests that inflation is still present, it unexpectedly slowed down compared to previous months. This could bring some relief, but it also indicates mixed signals about the economy’s health.

What Does This Mean for the Federal Reserve?

The Federal Reserve (often called the Fed) has been working hard to control inflation by adjusting interest rates—something that affects how much it costs to borrow money. With the CPI rising again, the Fed might face pressure to rethink its strategies. When prices rise, it can make it more challenging to keep a stable economy, leading to potential changes in interest rates. So, people are left wondering what the Fed will do next and how this will affect their wallets.

Inflation Trends: From Peaks to Progress

Looking at the broader trend, inflation has cooled significantly since its peak of over 9% back in mid-2022, which had many people worried deeply about rising costs. Now that the annual CPI has settled at 2.9%, it suggests that the Fed’s efforts have had some effect. However, it’s essential to note that while progress has been made, the latest numbers remind us that inflation is still a concern and something to keep an eye on.

Relief at the Grocery Store?

For many families, the grocery bill is a big part of their budget. The rising prices of food—especially eggs—have become a talking point across dinner tables in America. However, experts say that the holiday season brings about changes. Sometimes, prices can drop again after the busy shopping season. It’s a rollercoaster ride of prices that can leave families feeling uncertain about their spending.

What’s Next for Consumers?

Consumers might be asking, “What can we do now?” It’s essential to stay informed about prices and inflation trends, as this knowledge can help families plan their budgets better. Watching for sales and discounts and being mindful of spending habits can make a difference. With everything changing, being prepared can help families navigate their finances wisely.

Conclusion

As we look ahead, the December CPI numbers remind us of the ongoing dance between inflation and economic stability. While CPI climbed 0.4% and core inflation revealed unexpected slowdowns, it emphasizes the importance of careful money management. Everyone—from the Federal Reserve to individual families—is feeling the ripples of these economic changes, highlighting a journey that continues to evolve.