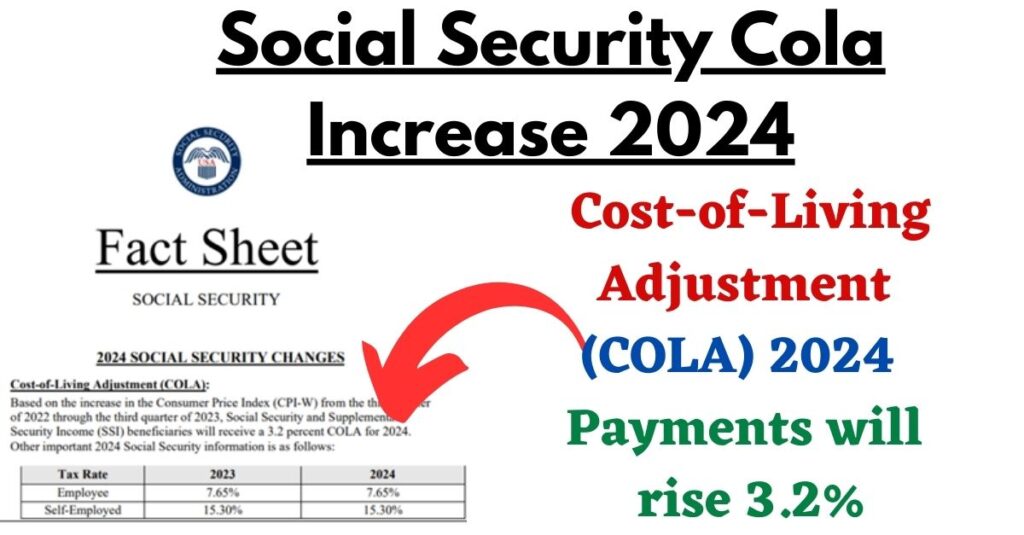

Through the provision of financial assistance through programs like Social Security Insurance (SSI) and Social Security Disability Insurance (SSDI), the Social Security Administration (SSA) plays a crucial role in helping elderly and handicapped residents in the United States. The Cost-of-Living Adjustment (COLA), which is intended to guarantee that the purchasing power of Social Security and SSI benefits stays constant despite inflationary pressures, is a vital component of this support. The Social Security Administration (SSA) has declared a rise in payments for 2024, with a maximum monthly benefit of $4,873, which reflects a 3.2% COLA. The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) serves as the basis for this modification. This article provides a thorough analysis of the 2024 COLA hike, covering its effects, qualifying standards, and payment schedules.

Background and Purpose of COLA

A yearly increase to Social Security benefits, the COLA is designed to offset the impact of inflation on fixed incomes. It is closely related to the CPI-W, which monitors changes in the costs of goods and services that urban consumers generally purchase. By comparing the CPI-W from the third quarter of the prior year to the present one, which reflects overall economic trends and inflation rates, the 3.2% increase for 2024 was calculated.

Impact of the 2024 Increase

The maximum monthly Social Security payout at full retirement age will increase from $4,555 in 2023 to $4,873 in 2024. For those at the top of the benefit scale typically those who have continuously made high salaries throughout their careers and have chosen to postpone claiming benefits until they are 70 years old this is a substantial gain. It is noteworthy, although, that the average monthly Social Security income as of February 2024 is roughly $1,911, meaning that the majority of claimants get significantly less than the maximum.

Detailed Eligibility Criteria for the $4,873 COLA Increase

To qualify for the maximum benefit increase under the COLA, applicants must meet several criteria:

- Residency and Citizenship: Applicants must be either U.S. citizens or permanent residents.

- Age Requirements: The standard eligibility age for full retirement benefits is 67 for those born in 1960 or later, although benefits can be claimed as early as age 62 at reduced rates. The maximum benefit amount, however, is available only to those who delay claiming until age 70.

- Earnings Record: The maximum benefit is calculated based on the individual’s 35 highest-earning years, adjusted for inflation. This means that only those who have consistently reached or exceeded the Social Security taxable income cap, which for 2024 is set at $147,000, are likely to see the maximum increase.

- Disability Status: Individuals who are disabled and meet specific medical criteria can also qualify for Social Security benefits under SSDI, though these are calculated differently from retirement benefits.

Payment Schedule for the $4,873 COLA Increase in 2024

Standard Payment Dates

Social Security payments are made monthly, with the date determined by the beneficiary’s birthdate:

- Birthdays from the 1st to the 10th: Benefits are paid on the second Wednesday of each month.

- Birthdays from the 11th to the 20th: Benefits are paid on the third Wednesday.

- Birthdays from the 21st to the 31st: Benefits are paid on the fourth Wednesday.

Special Payment Considerations

If a regular payment date falls on a federal holiday, the payment is typically issued on the preceding day. This ensures uninterrupted access to funds for beneficiaries.

Calculating Social Security Benefits

Social Security benefits are calculated using a progressive formula that gives lower workers a proportionately larger benefit than wealthier incomes. It entails taking the 35 highest-earning years’ indexed monthly earnings and average them. The primary insurance amount (PIA) is then calculated using a formula that includes “bend points,” which are percentages applied at various levels of average indexed monthly earnings.

Frequently Asked Questions (FAQs)

1. How is the Social Security COLA calculated?

The COLA is based on the percentage increase in the CPI-W from the third quarter of the last year to the third quarter of the current year.

2. Who qualifies for the maximum Social Security benefit of $4,873?

To qualify for the maximum benefit, individuals must have consistently earned at or above the Social Security tax cap for their 35 highest earning years and delay claiming benefits until age 70.

3. What is the average Social Security benefit in 2024?

The average monthly benefit for all retired workers is approximately $1,911 as of early 2024.

4. Can younger individuals with disabilities qualify for the $4,873 COLA increase?

Younger individuals with disabilities can qualify for SSDI benefits based on their own earnings records and the severity of their disabilities, but the maximum benefit amount may differ from the retirement benefit.

5. What should beneficiaries do if their payment is delayed or incorrect?

Beneficiaries should contact the SSA directly through their local office or via the SSA website to resolve issues with payments.

For eligible seniors and handicapped people in the US, the $4,873 COLA Social Security increase for 2024 provides a sizable financial boost that will help them keep their purchasing power in the face of inflation. Even though the maximum benefit is large, only people with high lifetime earnings who postpone benefits until later in life are eligible for it. It is essential to comprehend the qualifying requirements and payment schedule in order to optimize possible benefits.

If you want to Latest Update of Finance then Visit stevedigioia.com Here