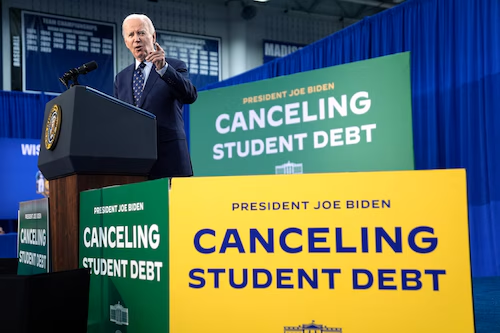

The Biden-Harris administration released an additional $7.4 billion in student loan relief, marking a significant step towards easing the terrible load of student loan debt in the United States. An astounding 277,000 borrowers who have long struggled with the financial burden of their school debts stand to gain from this most recent program. The declaration emphasizes the administration’s unwavering dedication to helping millions of borrowers and tackling the structural issues with the student loan system.

The rescue effort consists of multiple key elements, each carefully designed to address different aspects of the student debt situation. Fundamentally, it is based on President Biden’s Saving on a Valuable Education (SAVE) Plan, which provides qualified debtors with accelerated forgiveness benefits. Based on the original principal sum of their federal loans, borrowers who have faithfully made payments for a minimum of ten years are eligible for loan forgiveness under this plan. Borrowers with lower loans who have consistently met their repayment commitments over time stand to gain the most from this policy.

Additionally, the administration has changed income-driven repayment (IDR) plans administratively, which will help thousands of borrowers get closer to debt relief. These changes attempt to improve the forgiveness process and deliver much-needed relief to borrowers engaged in IDR plans by addressing issues related to loan servicers abusing forbearance.

Furthermore, the administration has implemented significant measures to tackle persistent issues within the Public Service Loan Forgiveness (PSLF) initiative. Through PSLF improvements, the government will provide $300 million in assistance to 4,600 borrowers in an effort to guarantee public servants obtain the promised loan forgiveness for their hard work.

These debt relief initiatives are important for reasons more than just helping the situation financially. As to a report published by the Council of Economic Advisors, these kinds of programs can have significant impacts on the financial stability, mental well-being, and consumption of borrowers, as well as wider economic metrics like homeownership and entrepreneurship. The administration aims to promote economic prosperity and financial well-being among American households by reducing the burden of student debt.

With the announcement of this extra debt relief, the Biden-Harris Administration has now granted an astounding $153 billion in loan forgiveness, helping almost 4.3 million Americans. Millions of people nationwide are benefiting directly from the administration’s efforts, as about one in ten federal student loan debtors have been authorized for some type of debt relief.

Reiterating the administration’s steadfast commitment to offering assistance to borrowers, U.S. Secretary of Education Miguel Cardona said, “Today’s announcement shows once again that the Biden-Harris Administration is not relenting in its efforts to give hardworking Americans some breathing room.” He reiterated the administration’s commitment to dealing with the structural issues with the student loan system and making sure that borrowers don’t have too much debt.

The Biden-Harris administration presented ideas earlier this week for additional student debt relief programs that will help tens of millions of students nationwide. In the administration’s continuous attempts to address the student loan crisis, these plans which include automatic discharge for qualified borrowers, help for those in financial hardship, and waivers for capitalized and accumulated interest—represent a major achievement.

Furthermore, the administration has a history of supporting borrowers that goes beyond the aforementioned programs. The administration has given assistance to borrowers who faced total and permanent disability, were enrolled in low-financial-value programs or institutions, or were deceived by their schools through a variety of initiatives and regulatory actions. These initiatives highlight the administration’s dedication to making sure that families and students do not face obstacles to opportunity because of student loans.

The administration’s debt relief measures are widely ranging, as evidenced by the revised state-by-state breakdown of borrowers granted for forgiveness under IDR and SAVE. These actions will help borrowers nationwide, from Wyoming to Alabama, proving the administration’s dedication to providing relief in a fair manner.

Finally, the announcement of an additional $7.4 billion in student debt relief by the Biden-Harris Administration is a critical turning point in their continued efforts to address the student loan crisis. In an effort to lessen the financial load that millions of Americans bear, the administration is helping hundreds of thousands of borrowers and setting the stage for future programs. The administration is unwavering in its commitment to fostering economic success and financial stability for all, even as it proceeds to enact extensive debt reduction measures.

Read Also – $1312 PFD Stimulus Checks 2024: Know Eligibility & Direct Payment Dates