The income payments that are exempt from taxes are known as personal allowances. Up to £12570, the personal allowance is not subject to taxation. If you claim a blind person’s allowance or a marriage allowance, the amount can be higher. Your income will determine your annual income tax payment. All income residents can receive before paying taxes is known as their allowance. The allowance rate has remained constant over the years, and if an individual’s income exceeds £100000, their allowance will be lowered by £1 for every £2. The information about the gov. uk Personal Tax Allowance for April 2024 may be found in the post below.

Personal Tax Allowance April 2024:

Individuals are exempt from paying any taxes up to a particular amount, which the UK government and the income tax department have set. The residents will be subject to tax rates over that threshold; no taxes will be collected below it. The income that exceeds the personal allowance and the income that is within the tax band determine how much income tax an individual must pay annually. The stated tax-free Personal Tax Allowance for April 2024 is £12570, and it will be in effect from April 6, 2024, until April 5, 2025. The rate of personal taxes won’t change until April 2028.

You cannot pay the taxes on this income if your allowance is less than £12570. The income exceeding the threshold limit will be subject to income tax rates determined by the income level in the event of self-employment or pay-as-you-earn. Precision is required since the gov. uk Personal Tax Allowance 2024 is used to create the tax code. The rate will be 20% on any income above £12570 and up to £50270 after it surpasses the specified maximum. The rates may change depending on the UK state; all rates are included in the tables below.

What is Personal Tax Allowance?

The amount of money you may earn or receive without paying taxes on it is your personal tax allowance. You are entitled to receive your tax allowance each year, which you give automatically and tax-free.

Your Allowance may increase if you get a Blind Person’s or Marital Allowance. You do not get the Personal Allowance if your taxable income is £125,140 or more; otherwise, it reduces by £1 for each £2 of income you earn beyond £100,000 in the same manner.

Personal tax allowances are available to UK taxpayers in many areas. While not all personal tax allowances are available to all UK taxpayers, some are.

| Post Title | Personal Tax Allowance April 2024 |

| Organization Name | Government of the United Kingdom |

| Country | United Kingdom |

| Tax Allowance Name | Personal Allowance Tax |

| Rate Applicable | £12570 |

| Dates Applicable | 2024, 6 April to 2025, 5 April |

| Tax rates | Mentioned Below |

| Post Type | Finance |

| Website | gov. uk |

UK Tax Code for the Year 2024–25:

- The tax code plays a crucial part in determining the income source of the personal allowance and is in line with your tax-free personal allowance.

- Given that the appropriate personal allowance rate is £12570, the standard code that applies is 1257L.

- Because of the numerous errors that might lead to an overpayment of income tax on the tax credit, it is crucial to ensure the tax code is accurate.

- If you feel that your tax code is inaccurate, you should contact HMRC.

- You may use the tax code checker to conduct the online check.

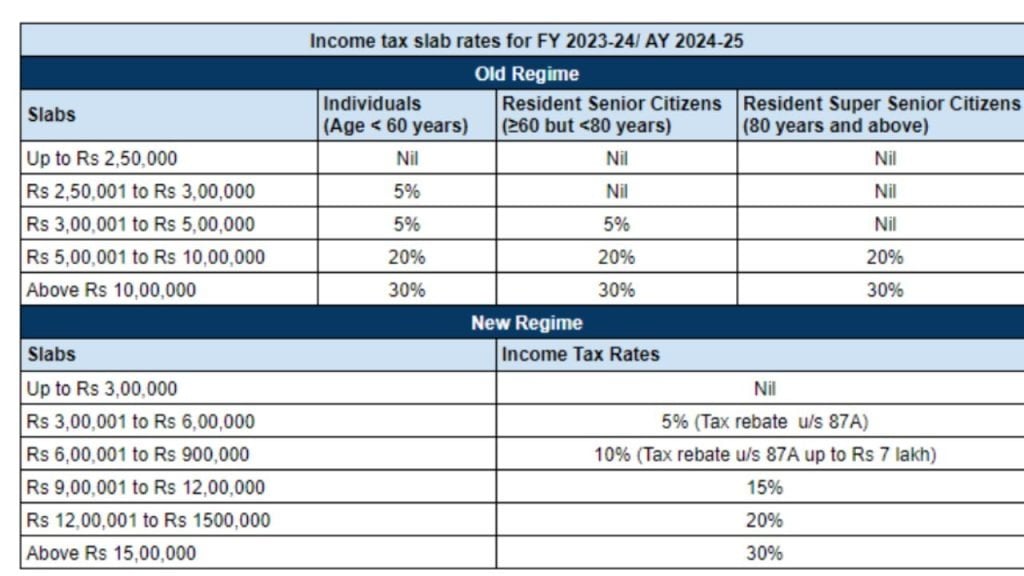

2024/25 Income Tax Bands:

You may find information about the appropriate income tax rates in the table.

| Band | Taxable Income | Tax Rate |

| Personal Allowance | Up To £12570 | 0% |

| Basic Rate | £12571 to £50270 | 20% |

| High Rate | £50271 to £125140 | 40% |

| Additional Rate | Above £125140 | 45% |

UK Income Tax Rates:

For the government, income tax is collected by HMRC. Income tax is divided into many bands. Your income increases together with your tax obligation. Your excess earnings over your Allowance is what you call your taxable income. By knowing this, you can calculate the amount of income tax you will owe.

If you make between £12,570 and £50,270 and reside in England, Wales, or Northern Ireland, your essential income tax rate is 20%. In these jurisdictions, people start paying 40% income tax at a higher rate threshold of £50,271.

19% income tax is applied on earnings in Scotland that fall between £12,570 and £14,732. Taxes will be paid on 20% of wages between £14,733 and £25,688 and 21% of revenues between £25,689 and £33,662. Earnings exceeding £125,140 are subject to the highest rate of 47%, while earnings between £43,663 and £125,140 are subject to the higher rate of 42%. We appreciate your allowing us to offer you this information on UK Personal Allowance.

| Band | Taxable Income | Tax Rate of Scotland |

| Personal Allowance | Up To £12570 | 0% |

| Starter Rate | £12571 to £14732 | 19% |

| Basic Rate | £14733 to £25688 | 20% |

| Intermediate Rate | £25689 to £43662 | 21% |

| High Rate | £43663 to £125140 | 42% |

| Top Rate | Above £125140 | 47% |

Making a Personal Tax Allowance claim:

- Before starting, you must verify your residence status.

- You will be informed if proving your nationality is required.

- You must calculate the tax year for which you are submitting a claim.

- To obtain the claim, you need to download Form R43.

- To fill out the form, make use of the instructions.

- The form has to be completed and then mailed to the designated department.

Eligibility:

The points about the 2024 Personal Tax Allowance Eligibility are listed below.

- The candidate has to be a UK resident.

- The recipient is a national of a European Economic Area country.

- You have worked for the UK government at any point in recent years.

Read Also – $1000 Hardship Tax Program 2024: How To Apply, Eligibility, Government Support